How AI Agents in Mineral Exploration Unlock Potential in Historically 'Failed' Drilling Programs: A Case Study in Data-Driven Exploration

RadiXplore uses AI agentic workflows to scan millions of open file reports, uncovering past drilling "failures" caused by technical issues—not geology—revealing overlooked mineral potential in under-tested targets

The path to mineral discovery is a challenging yet potentially highly rewarding endeavor, often characterized by years of meticulous geological work, substantial investment, and an element of calculated risk. It's a journey paved with perseverance, constant re-evaluation of complex datasets, and sometimes, a fortunate stroke of serendipity. But what if we could systematically enhance our odds of success by looking back, not just at celebrated discoveries, but at exploration efforts that were prematurely written off? Specifically, what if we could identify projects where the geology might have been promising, but the drill bit, for purely technical reasons, simply didn't go deep enough or accurately test the hypothesis? This is precisely where the powerful synergy of historical data archives, modern geological interpretation, and the transformative capabilities of cutting-edge AI and Agentic tools within the RadiXplore Platform is forging exciting new frontiers for intelligent project generation.

The Untapped Value in "Near Misses"

Vast repositories of geological information, such as Western Australia's WAMEX (Western Australian Mineral Exploration Reports database), house decades of accumulated exploration knowledge. These archives are, without doubt, invaluable goldmines of data, detailing past surveys, drilling results, and geological interpretations. However, they also contain countless records of drilling programs that were ultimately deemed "unsuccessful." A critical question, often buried under mountains of subsequent data or lost in the annals of corporate history, is why these programs were considered unsuccessful. Was the ground genuinely barren, offering no hint of economic mineralization? Or did unforeseen technical challenges—such as drilling equipment limitations, difficult ground conditions, or budget constraints—lead to drill holes failing to reach their intended target depth, thereby leaving the original geological concept inadequately tested and prematurely condemning the prospect?

Historically, the sheer volume and often unstructured, heterogeneous nature of these reports made the task of sifting through them to find such "near misses" a Herculean, if not impossible, undertaking. It required countless hours of manual review, a deep understanding of varied reporting styles spanning decades, and an intuitive ability to connect disparate pieces of information. Today, however, new agentic AI workflows are revolutionizing this process, offering an unprecedented ability to dissect and understand these historical datasets at scale.

RadiXplore: Illuminating Missed Opportunities at Scale

Imagine deploying a team of specialized AI agents, each designed for a specific analytical task, to systematically interrogate entire geological databases like WAMEX. This is precisely the advanced capability that RadiXplore brings to the modern explorationist. In a recent compelling case study, we utilized a sophisticated multi-agent approach to unearth these hidden gems:

This powerful, orchestrated workflow allows exploration teams to rapidly and efficiently pinpoint historical drill programs where the original geological hypothesis might still hold significant merit, simply awaiting competent and effective testing with modern techniques. The sheer scale, speed, and depth of this AI-driven analysis open up highly promising avenues for project generation that were previously impractical, time-consuming, and prohibitively expensive.

A Catalogue of Potential: Historical Near Misses from WAMEX

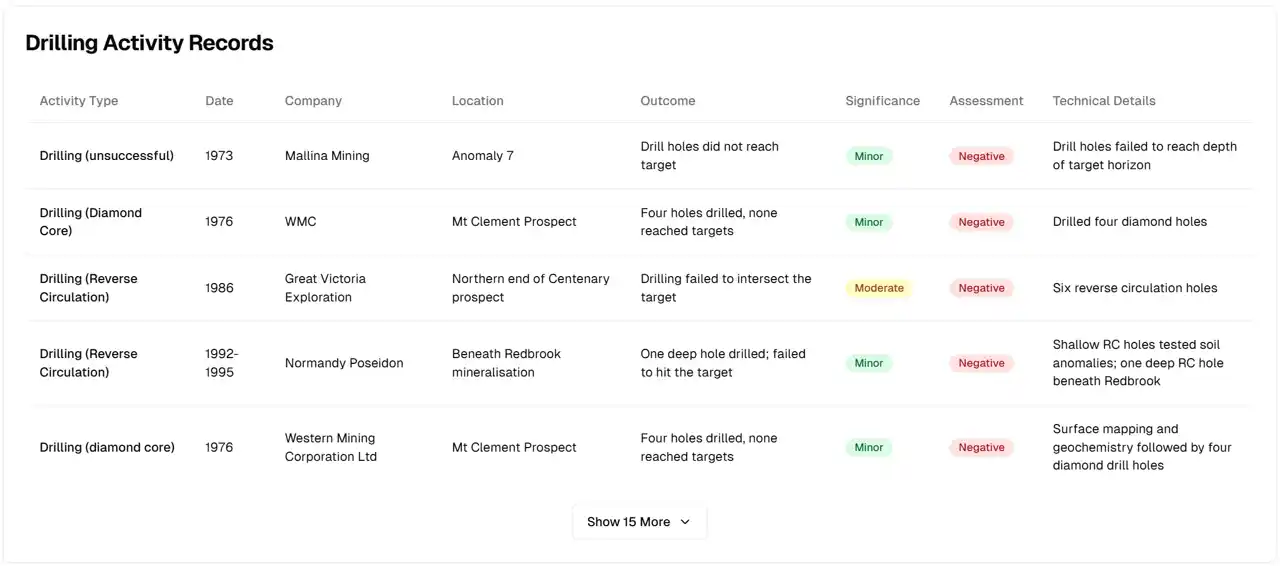

The RadiXplore agentic workflow, in its recent application, has successfully identified numerous instances of historical drilling programs across the vast expanse of Western Australia. These are programs that were reported as negative or discouraging, not necessarily due to a lack of geological promise, but primarily because the drilling operations fell short, were technically compromised, or failed to adequately penetrate the target zone. The following table presents the top examples unearthed by this study, highlighting the operating company, the specific location, the date of the activity, and, most importantly, the crucial detail that the intended target was not adequately tested, leaving potential discoveries untapped.

This curated list represents merely a fraction of the latent opportunities residing within historical datasets. Each line item is more than just data; it's a narrative of significant investment made, valuable geological data collected, but crucially, a geological question that was potentially left unanswered, beckoning fresh investigation.

Case Study: The Mangaroon Anomaly – From Uranium "Failure" to Polymetallic Hotspot?

Let's embark on a deeper dive into the very first entry from our list (Table 1, Row 1): WAMEX Report A48010. This report references drilling undertaken by Mallina Mining way back in 1973 at a location designated "Anomaly 7," where, critically, the drill holes "never reached target." This single statement is a powerful flag for potential re-assessment.

Utilizing RadiXplore's sophisticated AI Search capabilities, we can instantly trace the lineage of this information. While A48010 itself is a later compilation report, submitted in 1996 and covering a broader span of activities from 1973 to 1996 by Mallina Mining and other entities, understanding the original drilling context and commodity focus is paramount. The AI search rapidly and accurately identified the pertinent original 1973 report for the same general geographical area as A4049, authored by Esso Mineral Enterprises Australia Inc. A48010 (a 1996 Mallina report) references 1973 drilling, and the original drilling activity was conducted by Esso in 1973. This ability to connect related reports across time and different operators is a key strength of the AI-driven approach.

A Glimpse into the Past: Report A4049 (Esso, 1973)

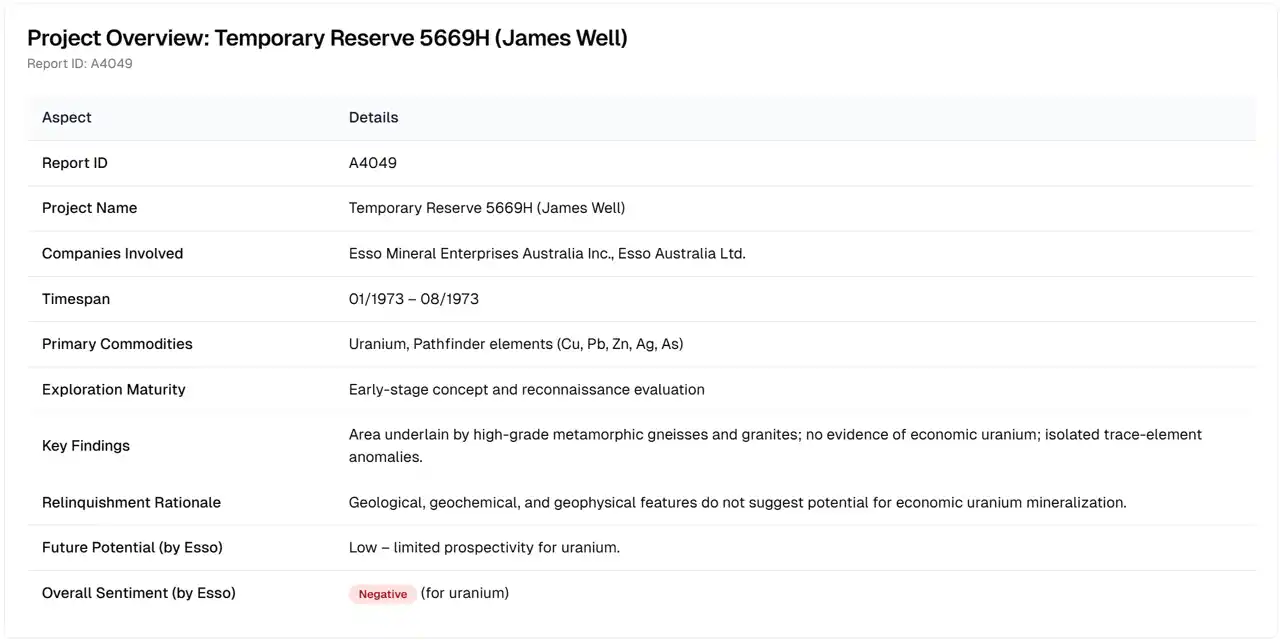

RadiXplore agents efficiently processed and provided a concise, structured overview of this foundational 1973 report, offering immediate insights into the historical context:

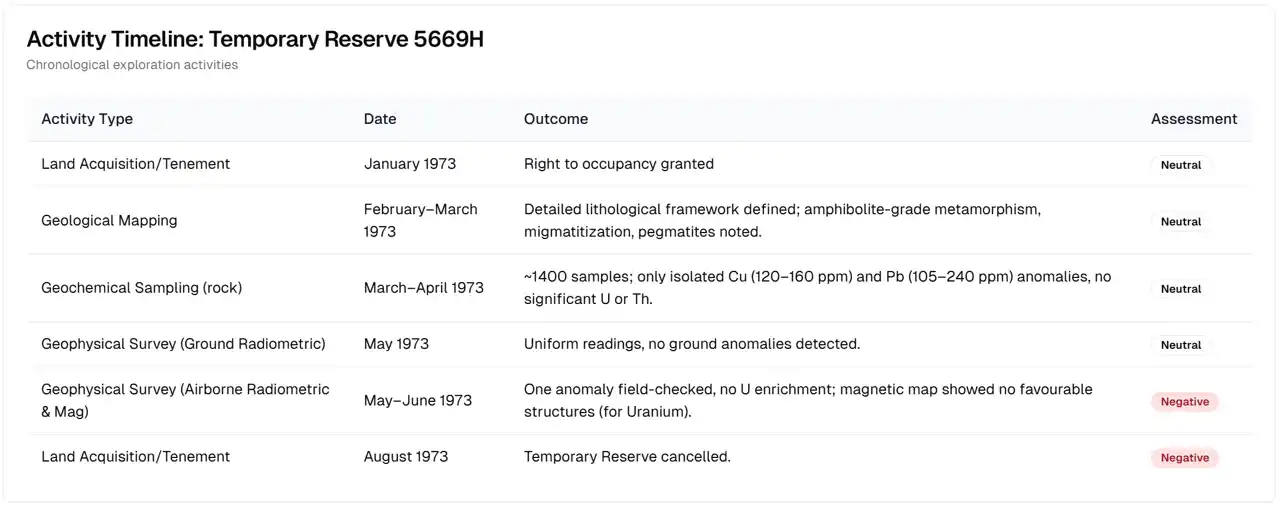

Esso's exploration program in 1973, typical of many major companies during that era's uranium boom, was squarely and almost exclusively focused on discovering Uranium. Their activities, meticulously and systematically summarized by the AI Agent from report A4049, provides a clear picture of their efforts:

What's Interesting Here? A Modern Re-interpretation

From Esso's 1973 perspective, with their singular focus on uranium, the Mangaroon area was deemed unprospective. They found no significant uranium anomalies, their prevailing geological model for uranium deposits was not supported by the field data, and consequently, they relinquished the ground. However, when viewed through a modern, multi-commodity lens, and with the benefit of evolving geological understanding, several critical points stand out:

- Dismissed Pathfinders: Esso duly noted "isolated Cu (120–160 ppm) and Pb (105–240 ppm) anomalies" in their rock chip geochemistry. In the context of their uranium hunt, these were considered insignificant. However, for explorers targeting base metals or even certain styles of gold mineralization, these values, while not high-grade, could be subtle but important vectors or indicators of a larger, nearby mineralizing system.

- Geological Setting's Untapped Potential: The area is described as comprising "high-grade metamorphic gneisses and granites." While these lithologies were not deemed prospective for Esso's specific uranium model at the time, such complex geological terrains are now recognized as potentially fertile hosts for a diverse range of mineralization styles, including orogenic gold, magmatic nickel-copper sulphides, and REE deposits associated with specific intrusive phases.

Fast Forward: Report A48010 (Mallina Mining et al., context of 1973 drilling)

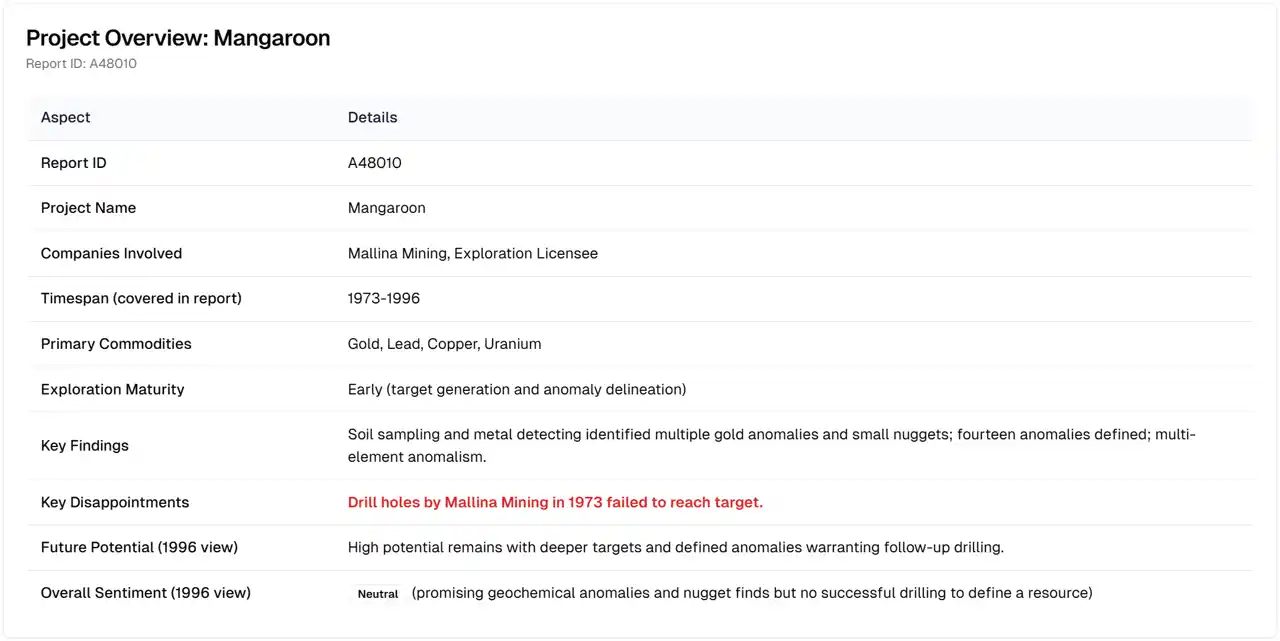

Now, let's revisit report A48010 by asking the AI Agent for an overview. This report is particularly insightful because it specifically mentions the Mallina Mining 1973 drilling campaign at "Anomaly 7"—the one that failed to reach its intended target:

The 1996 report (A48010), compiled with a broader commodity focus that now explicitly included Gold, Lead, and Copper alongside Uranium, paints a significantly different and more optimistic picture of the Mangaroon area's prospectivity. It highlights:

- Tangible Gold Presence: The discovery of multiple gold anomalies through systematic soil sampling and even small gold nuggets via metal detecting provided concrete evidence of gold mineralization in the area.

- Broader Multi-element Anomalism: The recognition of multi-element anomalism suggested a more complex and potentially widespread mineralizing system than previously considered.

- Crucially, and central to our thesis, Report A48010 explicitly states that historical 1973 drill holes at Anomaly 7 (coinciding with Esso's uranium-focused work in the general region, and likely representing Esso's or another contemporary's efforts) failed to reach their intended target.

Connecting the Dots: The Modern Mangaroon Project and its Historical Echoes

Today, the Mangaroon area is the focus of significant exploration activity by Dreadnought Resources (ASX:DRE). Their Mangaroon Project has rapidly gained prominence for its exciting potential to host significant Gold, Rare Earth Elements (REE), and Base Metals (Copper, Nickel, PGEs). This modern success story has intriguing echoes in the historical data.

- Geological Context Re-evaluated: Dreadnought's successful exploration programs have highlighted the critical importance of geological features such as the Gifford Creek Carbonatite Complex for REE mineralization, and major regional structures like the Minga Bar and Edmund Faults as conduits and traps for shear-hosted orogenic gold. The region's Proterozoic basins and associated intrusions are also recognized as highly prospective for various base metal deposits. This refined geological understanding provides a new lens through which to view the old data.

- Could Historical Data Have Pointed the Way, Sooner?

- The "isolated" Cu and Pb anomalies noted and then dismissed by Esso back in 1973, while not significant uranium targets, could very well have been subtle geochemical footprints—early, albeit faint, clues pointing towards the broader base metal potential that is now being actively and successfully pursued.

- The "multi-element anomalism" and concrete gold finds detailed in the 1996 report (A48010) are directly relevant to, and supportive of, Dreadnought's current gold exploration focus and discoveries.

- Perhaps the most critical piece of intelligence, brought sharply into focus by RadiXplore's targeted semantic search, is the explicit statement (found in Mallina's 1996 report A48010, referencing earlier work) that the 1973 drilling at Anomaly 7 (likely undertaken by Esso, as suggested by Report A4049 context) did not adequately test the target.

If the 1973 drilling at Anomaly 7 (referenced in Mallina's 1996 report and likely undertaken by Esso)—which, even if part of Esso's uranium hunt, might have inadvertently tested a feature prospective for other commodities—was aimed at a specific geological, geophysical, or geochemical feature indicative of gold or base metals, but failed to reach the interpreted source of that anomaly due to drilling limitations of the era or difficult ground conditions, then that target remains effectively open and untested. Modern exploration, armed with this crucial historical insight and equipped with more powerful and precise drilling technology, can revisit these historically "failed" yet highly prospective locations with a significantly improved understanding and a much higher probability of success.

This detailed Mangaroon case study powerfully demonstrates the unique value proposition of RadiXplore:

- It meticulously identified a critical "failed to reach target" drilling event from a later compilation report (A48010), an insight easily missed in manual reviews.

- It rapidly and accurately linked this event back to the original, commodity-specific exploration context detailed in an earlier report (A4049), providing essential historical perspective.

- It facilitated a nuanced re-interpretation of what was initially considered "negative" historical data, viewing it in the light of evolving geological models, shifting commodity interests, and modern exploration successes in the same area.

The Future of Exploration: AI-Assisted Discovery – Turning Past Efforts into Future Wins

The Mangaroon example is a compelling illustration, but it is just one instance among potentially thousands. How many other "failed" drilling programs, logged away in historical archives across Australia and worldwide, actually represent untested or under-tested potential, simply awaiting rediscovery through intelligent data analysis?

The capability to systematically and rapidly screen decades of accumulated geological data for specific, high-potential scenarios like "drilling failed to reach target" represents a paradigm shift in exploration strategy. It empowers exploration companies to:

- Generate high-quality, lower-cost drill targets: Revisiting areas with documented mineralization indicators, known geological anomalism, and, crucially, inadequately tested historical drilling is often far more capital-efficient and geologically targeted than pure grassroots exploration in virgin terranes. It leverages past expenditure to inform future success.

- Significantly reduce exploration risk: By focusing on areas where previous exploration efforts encountered technical hurdles rather than definitive geological dead-ends, companies can de-risk their exploration programs. The presence of smoke (anomalism, shallow intercepts) where the fire (economic deposit) wasn't reached due to technical failure is a strong leading indicator.

- Leverage and unlock the immense value of historical investment: Billions of dollars have been spent on past exploration. The data generated from this expenditure has already been collected and paid for; AI simply provides the key to unlock its often-dormant, hidden value, turning sunk costs into future opportunities.

As sophisticated AI tools like RadiXplore become increasingly integrated into standard exploration workflows, we can confidently expect a new wave of mineral discoveries. These discoveries may not always come from venturing into entirely unknown frontiers, but increasingly from intelligently and systematically revisiting the "near misses" and "technical failures" of the past. The geological treasures are often already there, buried not just beneath the earth, but within the vast archives of our collective exploration history – it's time to bring them decisively to light.

Untapped Potential Within Open File and Private Historical Data

Across Australia, Canada, and Saudi Arabia, there exists a treasure trove of openfile data and private reports sitting within corporate repositories. These datasets, amassed from years of exploration efforts, represent a largely untapped resource that could host the key to future mineral deposits. Often underutilized, this wealth of information holds the promise of revealing new opportunities when paired with cutting-edge technology. By harnessing AI-driven tools, companies can revisit these records, uncover hidden patterns, and pinpoint prospects that might have been overlooked in the past. The future of exploration might not lie solely in new fieldwork, but in reimagining the data already at our fingertips.

Take the Next Step

Curious about how this could work for your projects? Contact us today to explore how our AI-powered solutions can unlock the potential of your historical data.

Contact Us To See It in Action